6 Expense Analysis

The three principal drivers of expense ratios are acquisition costs, operating expenses and reinsurance spend. The first two affect the numerator of the ratio, the last item affects its denominator.

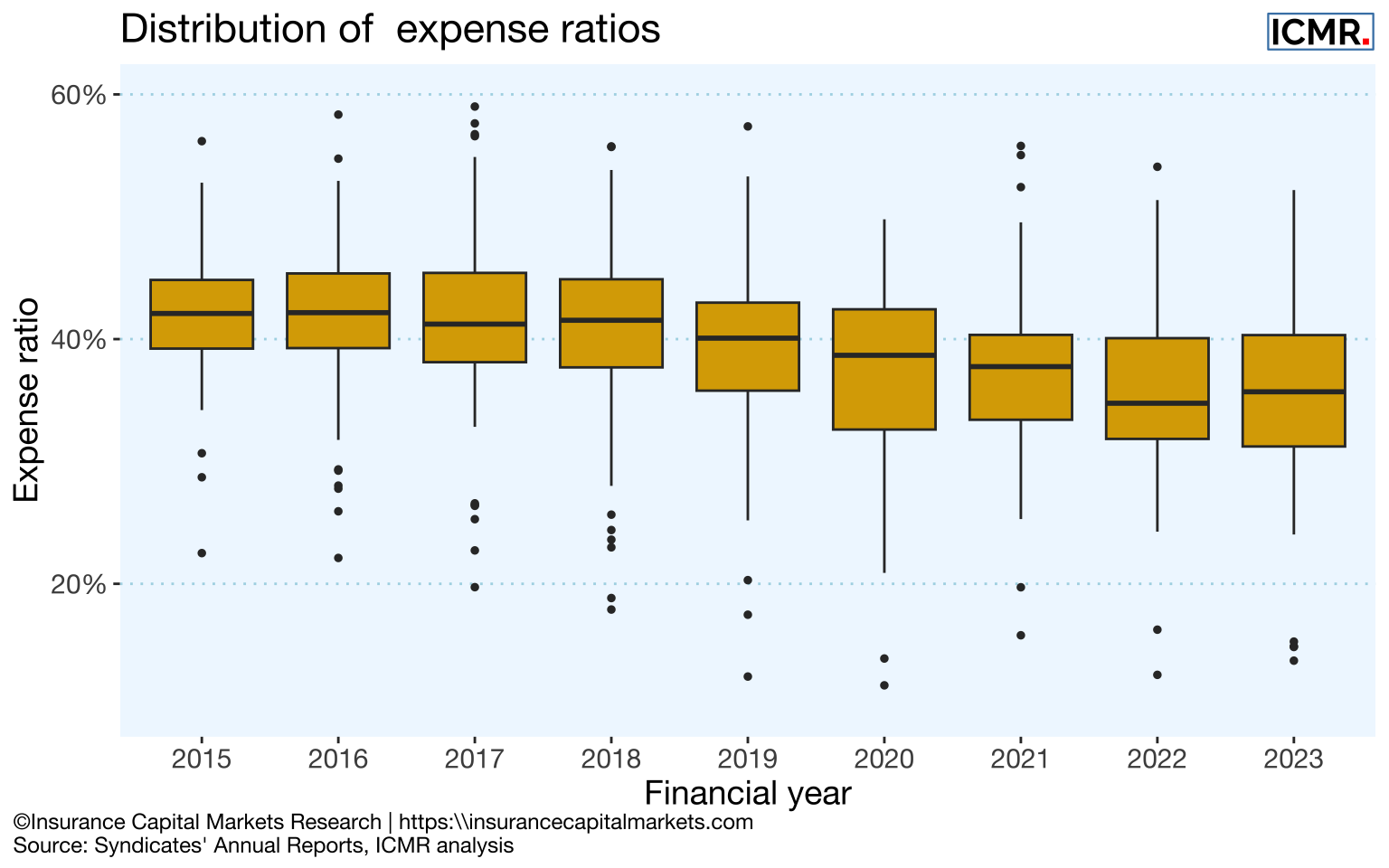

Expense ratios have been generally declining from a peak of over 40% of net earned premium.

6.1 Net expense ratio

It can be very difficult for syndicates to reduce acquisition costs over time, particularly with the growth of MGA and binding authority business which carries much higher acquisition costs than, say, reinsurance business. Equally, operating expenses tend not to be subject to rapid flux, as syndicates build out their infrastructure and staffing levels.

The most impact on expense ratios tends to come from a syndicate’s reinsurance spend; the less spent, the greater the net earned premium, the lower the expense ratio.

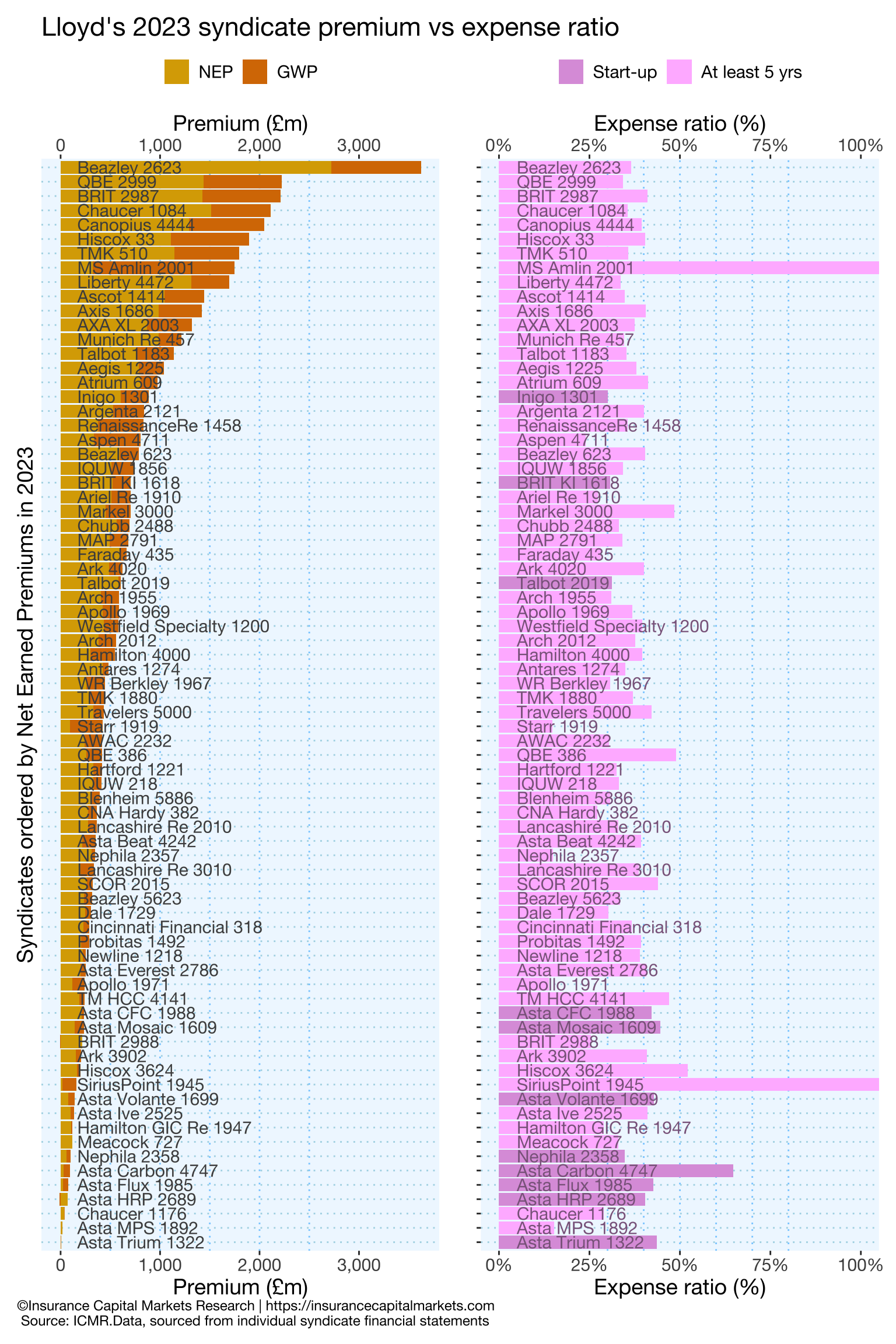

6.2 Does size matter?

As is apparent from the above chart, the model of underwriting at Lloyd’s does not lead to consistently lower expense ratios at scale. Similar expense ratios apply for syndicates orders of magnitude bigger than others.

This reflects the high proportion of expenses that are variable with premium, such as broker remuneration and protecting downside risk with reinsurance. It also suggests that the Lloyd’s central service infrastructure enables much smaller, bespoke carriers to operate profitably in a way which would not be possible outside Lloyd’s.

Economies of scale are only available through stable process management and a trend to watch for in future is the extent to which market digitalization and consequent changes to Lloyd’s cost charging structures allow the larger syndicates to realise economies.