What does value creation mean in the Lloyd’s market?

Introducing the London Insurance Market Index

A superficially simple question (apply a mean industry multiple of book value) but whose follow up questions become increasingly complex - How is this value distributed between managing agents and the centre? How between managing agents themselves? How can value be extracted beyond annual underwriting profit streams?

This question of how value is derived has become increasingly relevant with increasing risk capitalisation through alternative assets managers; do underwriters create more value from underwriting using their own capital or from fees derived from using capital from 3rd parties? Experience suggests there is an optimum balance between the two, but the fulcrum is moving.

As a diverse marketplace, the creation of value at Lloyd’s and its subsequent extraction does not fall evenly amongst market participants. Unaligned capital, by which is meant capital with no ownership interest in managing agencies, can benefit fully from the underwriting prowess of managing agencies in terms of annual profits, but cannot participate in that managing agency’s value creation. That is solely the preserve of its shareholders. Unaligned capital enters the market at 1x Book Value and leaves at the same multiple. Even Lloyd’s Blueprint One proposals for “follow-only” capital will be the same, unless that “follow-only” capital itself incorporates in some manner.

So is value creation at Lloyd’s solely the preserve of those lucky enough to own managing agents? For the foreseeable future, probably. But how can a lay person attempt to quantify the value creation for what are opaque and mainly illiquid companies?

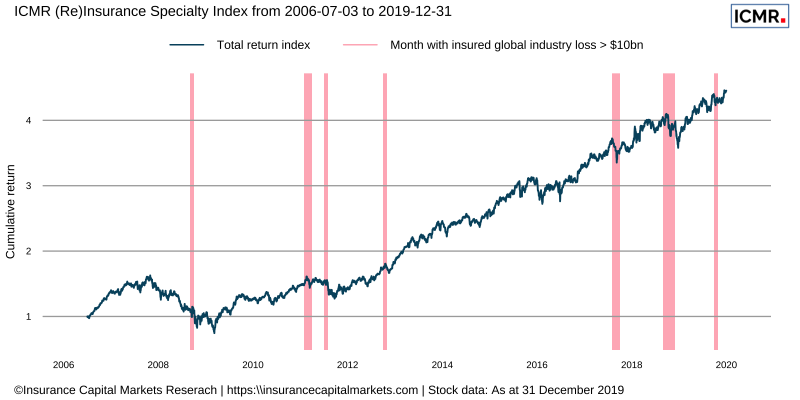

One way is to create an ‘as-if’ Lloyd’s of London “stock”, simulating a return and thereby imputing a value by using a combination of financial instruments, rather than a single conventional investment.

Such an approach might be of anecdotal interest to those agencies or potential acquirers, but so what? Can this information be used in a way that new investors can share in Lloyd’s value creation? We believe it can and that is by using a liquid stock portfolio as a new type of Lloyd’s Index. Lloyd’s Indices have been discussed before, but more as risk trading tools than as direct investment opportunities. Given how much of Lloyd’s now has a publicly listed parent company (over 80% today, up from 60% in 2005), a simple index modelling approach can enable investors to share in some of the value creation those publicly listed companies have enjoyed from owning Lloyd’s managing agents.

Such an index also shows the success of Lloyd’s Performance Management regime in approving fit and proper owners of managing agents. For more information and a demonstration on this and its underlying data, please contact us.