Beyond the Market Cycle: Using AI to Redefine Performance at Lloyd's

Why a shift from absolute metrics to relative benchmarking is key to identifying true outperformers in the Lloyd’s market.

The limitations of absolute performance metrics

The Lloyd’s market, with its unique characteristics and complexities, presents distinct challenges for performance analysis. Traditional methods, which often focus on historical absolute performance figures, can be misleading. These figures are heavily influenced by market cycles, making it difficult to distinguish genuine outperformers from those simply riding a market-wide wave. In a soft market, absolute metrics may inflate performance across the board, while in a challenging one, they can make even well-managed syndicates appear to be underperforming.

The power of a relative perspective

To overcome these limitations, the focus is shifting to understanding relative performance: how a syndicate performs compared to its direct peer group. In a dynamic market, this provides a more stable and insightful indicator of underlying capabilities and strategic effectiveness. Relative performance enables more accurate benchmarking, helps to identify genuine competitive advantages, and offers a clearer picture of long-term sustainability, independent of broader market fluctuations.

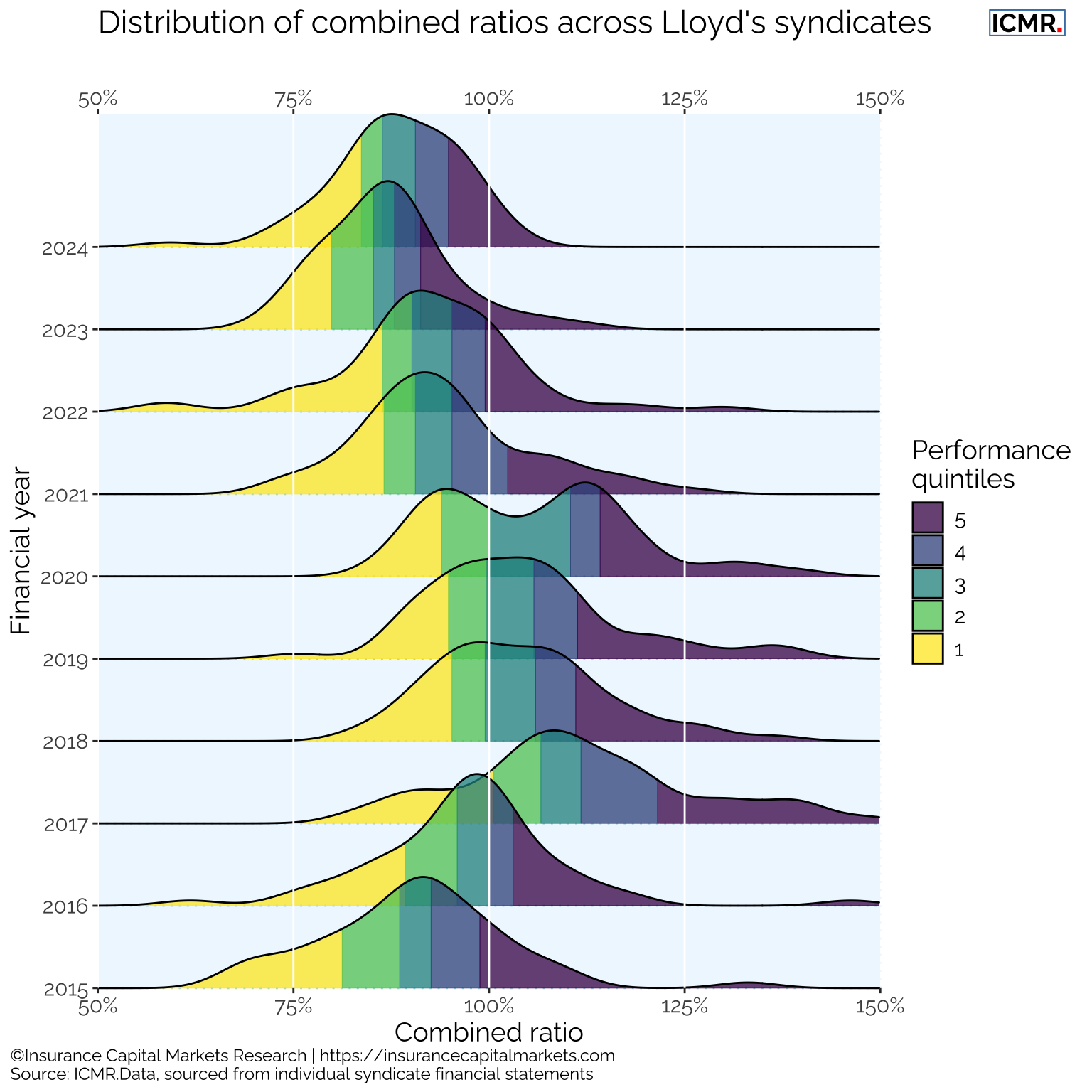

This stability is evident in historical data. As illustrated in the chart below, which shows the distribution of syndicates’ net combined ratios over the past decade, transition matrices reveal that the composition of each performance quintile is relatively stable year-on-year. For any given syndicate, the most likely outcome is to remain in the same quintile the following year.

The secret sauce

While the underlying theory is not new—indeed, the founders of ICMR pioneered this modelling concept during their time leading Lloyd’s internal analytics and research function—the convergence of two factors has recently made its practical application possible: broader access to relevant performance data and the widespread availability of powerful probabilistic programming languages.

ICMR has developed an innovative AI-powered model to predict the relative loss ratio performance of Lloyd’s syndicates. The model is based on a Bayesian AI framework, similar to established models like the Plackett-Luce model, which is designed specifically for predicting the ranked performance of peers. This is fuelled by ICMR’s curated dataset of gross underwriting performance, broken down by syndicate and class of business.

From data to decision

The model’s output allows for a nuanced, forward-looking view of performance. This can be visualised in a scatter plot that positions individual syndicate classes of business based on two key metrics: their predicted future profitability (predictive performance) and the consistency of that performance over time (stability).

Syndicate classes in the top-right quadrant are the most desirable, exhibiting strong predicted performance combined with high stability. Conversely, those in the bottom-left show weaker, less stable predicted performance. The ultimate purpose of this relative performance analysis is to drive demonstrably better underwriting outcomes. This is achieved by overlaying these relative insights with absolute market-level forecasts to produce a complete distribution of potential market outcomes.

Gaining a strategic underwriting advantage

Relying solely on traditional absolute performance metrics provides an incomplete and often misleading picture of the Lloyd’s market. By shifting the focus to relative performance and harnessing the power of predictive AI, a new level of strategic insight is unlocked.

ICMR’s analysis provides clear evidence that this approach enables the targeting of a portfolio with superior expected performance and lower volatility compared to a relevant market benchmark. In a recent white paper published with one of our clients, we demonstrate how these insights empowered the syndicate’s management to systematically improve the quality of their portfolio year-on-year.

If you would like to learn more about ICMR.Insight and how it can help you gain a deeper understanding of underwriting performance, please get in touch or read our recent case study