Capital markets slowly falling back in love with (re)insurance

ICMR analysis shows (re)insurer P/b’s close to long term highs, but still relatively undervalued

After the banking sector turmoil in Q1 this year, capital markets’ confidence in the specialty (re)insurance industry has returned to some extent following a series of favourable H1 2023 results.

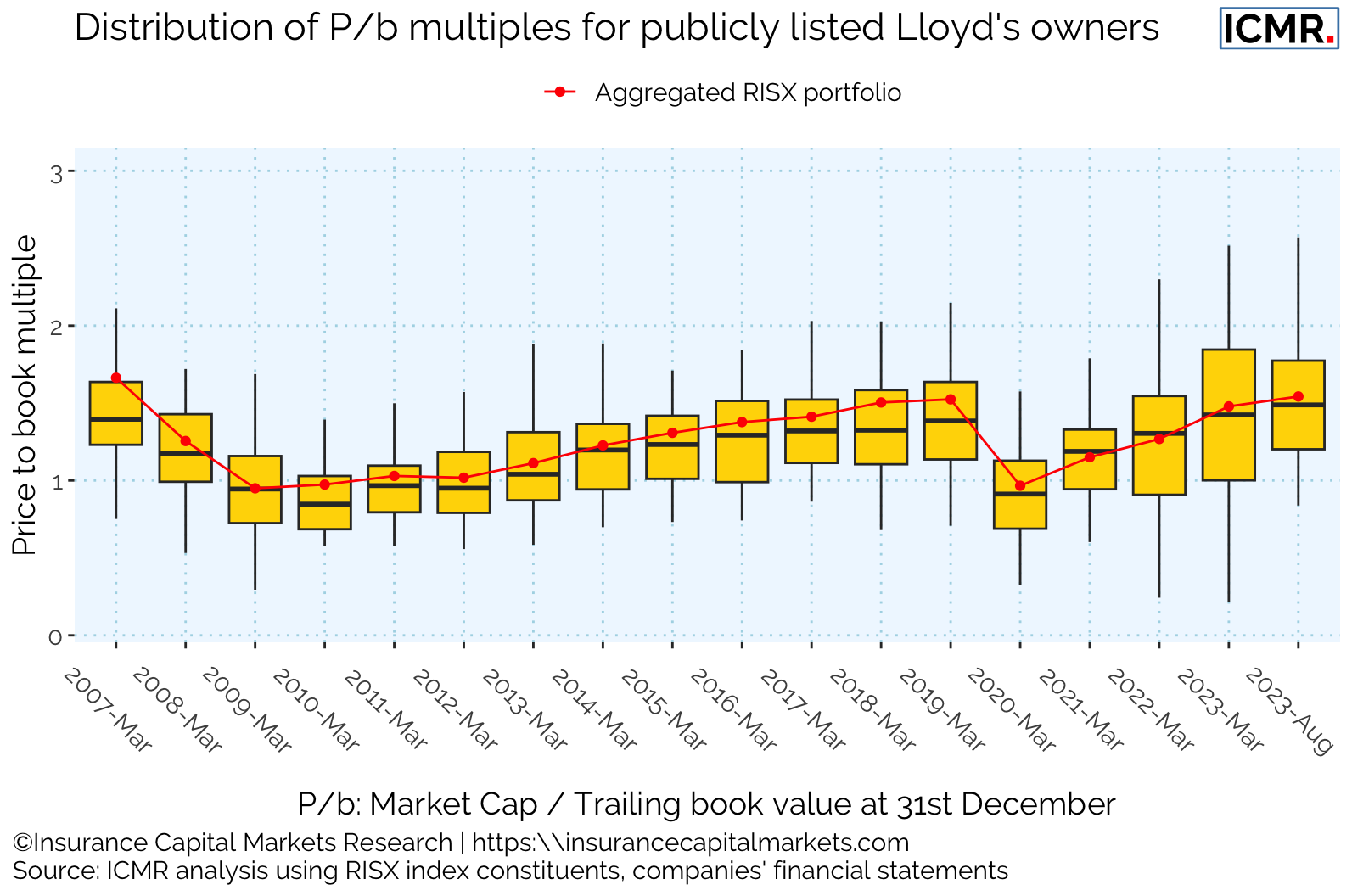

This is demonstrated by the increases seen in price to trailing book multiples (P/b) for the RISX equity index of publicly listed Lloyd’s owners. This is now at similar levels last seen just before the 2008 financial crash.

All positive news, until one compares it with broker rate on line (ROL) indices. Whilst these are subjective, many have been running long enough to provide a reliable indication of direction of travel for individual sectors.

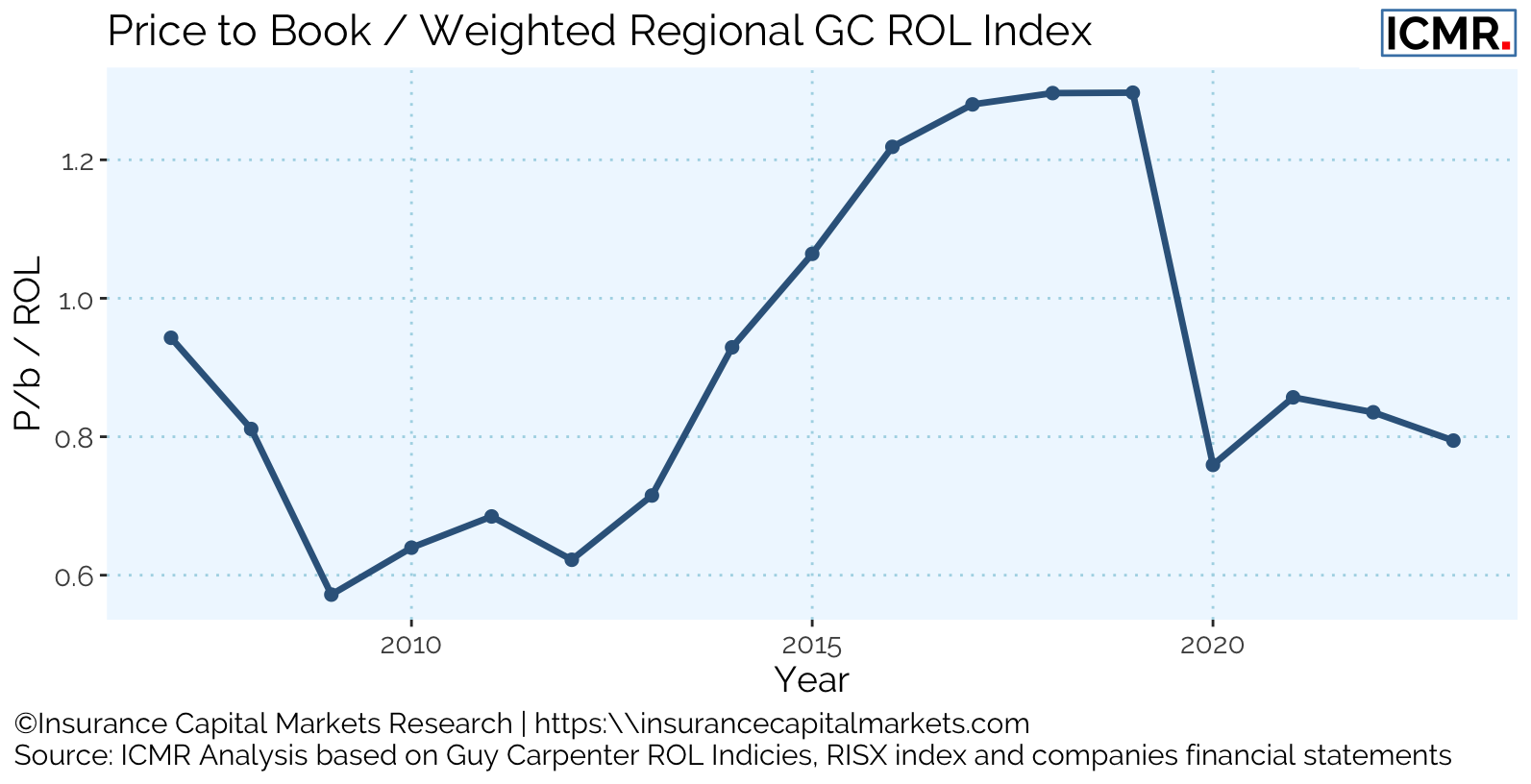

Using a hybrid of multiple broker rate on line indices, this shows an incredibly strong recovery since COVID. Comparing this against the RISX portfolio of (re)insurance company P/b’s reveals that, despite the rise in P/b, it remains much lower than what would be expected from the increase in ROL.

This chart shows the P/b divided by the ROL Index ; in effect showing a ‘Price to Profit Potential’ ratio. It illustrates that despite the high P/b’s, equity pricing relative to the ROL indices is flat and below expectation.

This might explain why some of the Private Equity owned (re)insurers have still not yet returned to public markets. It even suggests that the window for new Private Equity acquisitions may not in fact be closed.

The (re)insurance industry is poised for growth in the coming years. Investors willing to take on risk now, rather than awaiting more confirmatory data points, could be well-rewarded for early mover advantage.

This article was also published as a Viewpoint by The Insurer.