Specialty (re)insurance M&A - price to book multiple trends

RISX index suggests tidy return for Ascot’s investors

At the end of last week we learned from Reinsurance News that Ascot is up for sale. Ascot, currently owned by CPP Investments, is a highly regarded specialty underwriting company. So, what might an outside-in valuation look like?

Specialty (re)insurance, whilst a globally significant industry in its own right, has no standard classification by company. That’s why ICMR established the RISX index, the first equity index dedicated to the global specialty (re)insurance sector. The RISX index is based on the listed companies that participate in Lloyd’s, since the performance of Lloyd’s is seen as a fractal and therefore a benchmark for the industry.

The price to book (P/b) multiples of the RISX index companies over time provides a sensible comparison to look at deals in the specialty (re)insurance sector and Lloyd’s in particular.

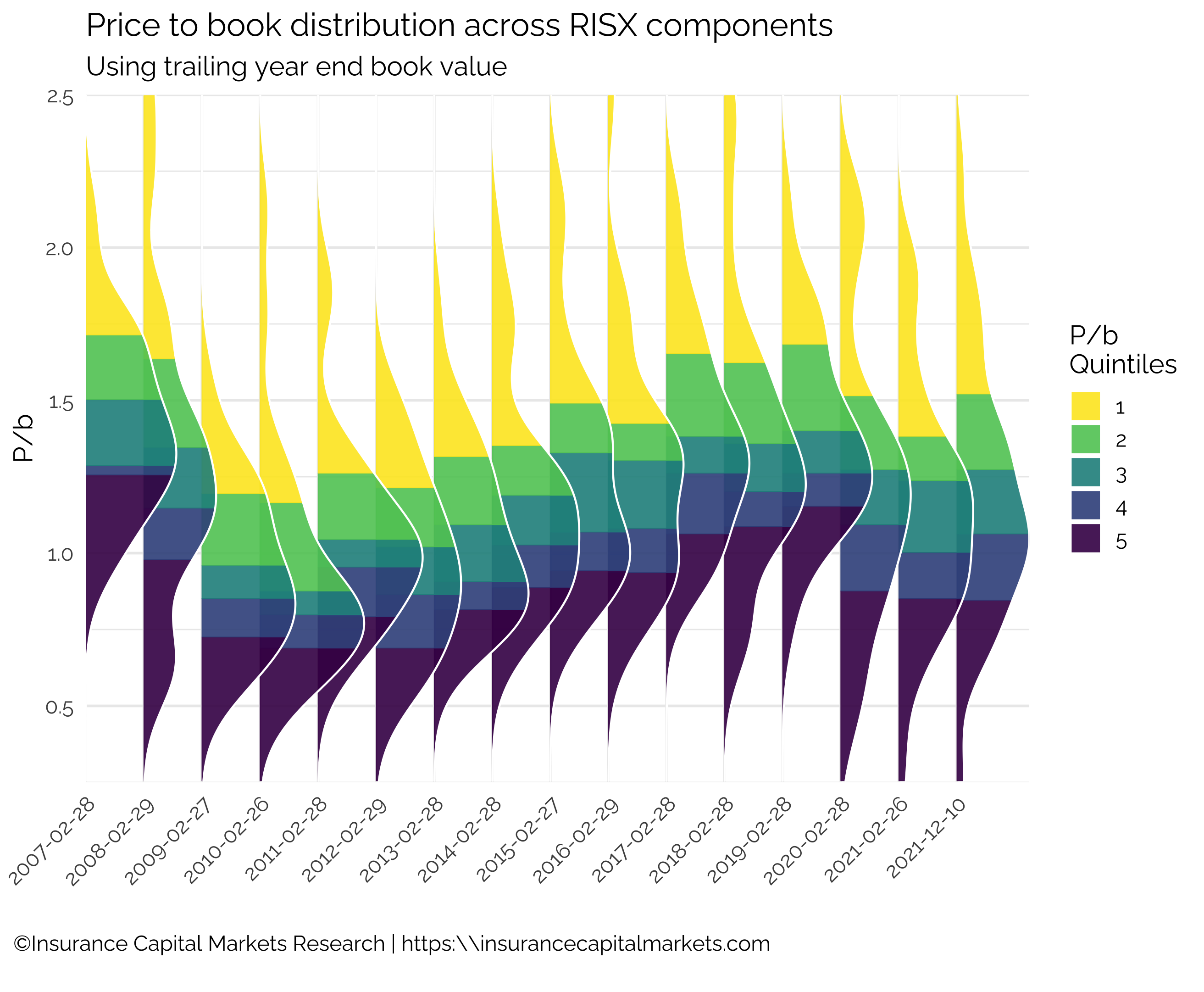

The chart below shows the P/b multiple distributions at the end of February of each year, i.e. at the time the annual results were published, plus the distribution of P/b multiples of last Friday, 10 December 2021.

For each date the chart shows the range of actual P/b multiples across the sector, with the ranges of P/b quintiles highlighted (we’ve defined P/b as the ratio of market capitalisation to trailing shareholders’ equity in the balance sheet).

After a high of valuations in 2007 the sector was dragged down during the financial crisis. We notice a slow but steady recovery until early 2017, followed by decline and what looks like a recovery again; signs of a hardening market being priced in.

What does this tell us about Ascot? It was acquired by CPP Investments in 2016 for US$1.1bn (P/b multiple of ~1.6x NTA). When comparing its recent performance to the above distribution of P/b multiples, they would fall firmly in the top quintile with, we estimate, a P/b multiple still around 1.6x. And this is despite shareholders’ equity more than doubling over that time, pointing to a tidy return on investment.