RISX Index: more than just a benchmark

This article outlines some of the drivers behind the creation of the RISX index

On the 24th of May this year, ICMR announced the creation of the RISX index of the publicly listed owners of Lloyd’s managing agencies with Moorgate Benchmarks. In various media interviews (Financial Times, Reinsurance News) we explained why, given the aggregated performance characteristics of the index, it is a useful benchmark for investments made in Lloyd’s. But we believe it is more than that.

We argue the RISX index helps in valuing performance at Lloyd’s and provides greater transparency through:

- Understanding how underwriting earnings build in the course of a year on a daily basis

- Insight into how major catastrophe events impact valuation

- A better understanding of capital markets valuation of underwriting performance and with that, potential new avenues in capital markets risk transfer

Valuing performance at Lloyd’s

Value creation in insurance has always been a tricky subject and particularly so at Lloyd’s. We know some acquisitions have been made at industry-leading multiples of book value but as a metric, it remains an abstract concept. Lloyd’s fundamentally agency-based structure and the opacity of capital required to trade further hinders transparency. And yet as an industry, careers and fortunes are made and remade through understanding how underwriting performance over time impacts valuation over time. We have plenty of historical information on Lloyd’s performance, but no proxy for valuation over time. Until now.

Using the RISX index, we can start to see valuation patterns emerge, principally from changes in the book value price multiple. This in turn gives insight into cyclical valuation and even sentiment on premium rating adequacy, at least from a capital markets perspective.

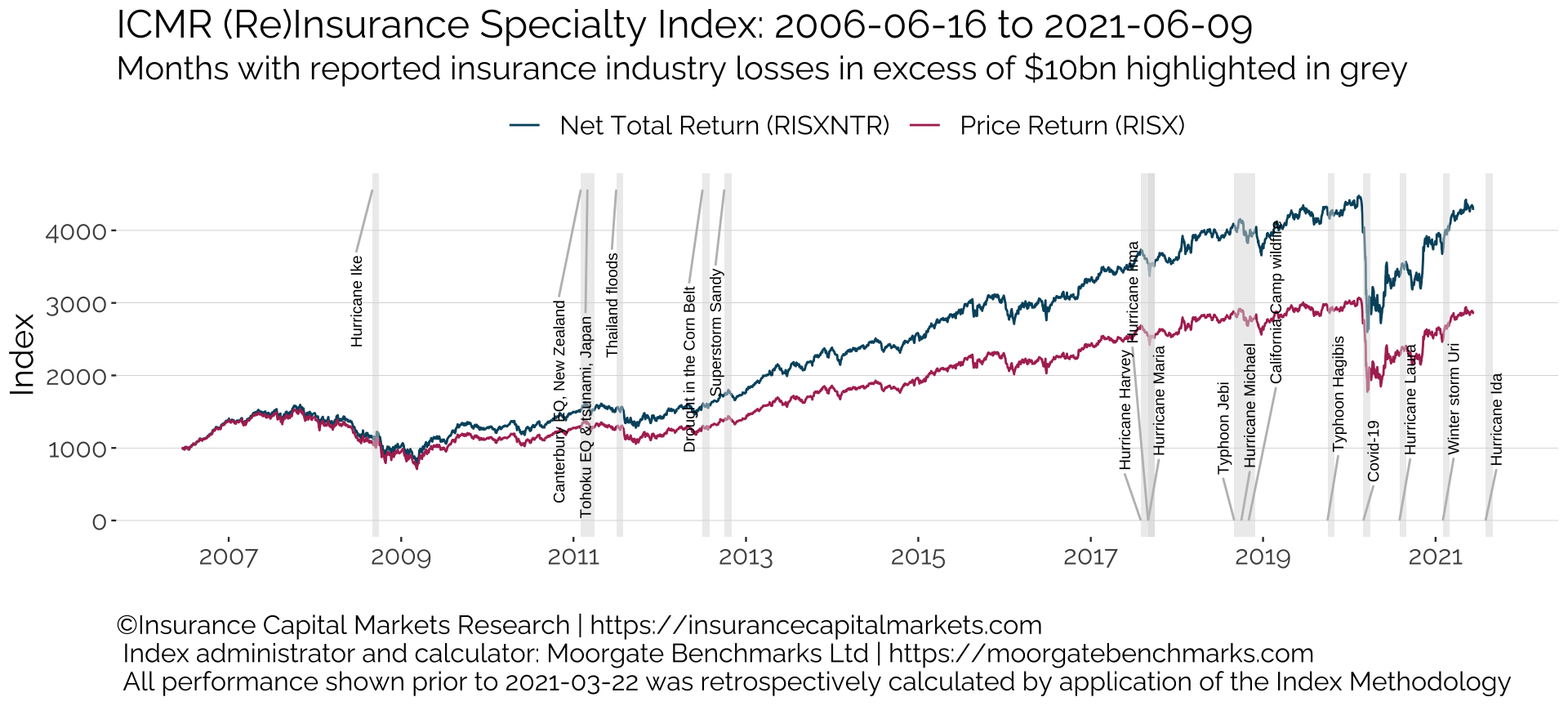

Major global economic upheaval aside (the financial crisis and COVID), the RISX index shows a very steady, almost linear growth over a multi-year time frame, demonstrating a certain predictability in earnings and dividends over time.

Plotting movements in the RISX Price Return index against major catastrophe events shows the difference between the impact of the event itself versus the impact it has on confidence over a longer time frame (see chart above). Few major natural catastrophes leave a long term dent in the index performance.

Finally, we have shown in the RISX white paper the close relationship between the underwriting and return on capital characteristics between Lloyd’s and the RISX index. It is not a stretch to see investors satisfying their insurance risk appetite through derivatives of the RISX index, such as swaps and structured products.

Increasing transparency

A wise actuary once said: “data can’t tell you everything, but you must always extract everything it can tell you.” The RISX index is a proxy for Lloyd’s in the aggregate, made up of public domain data from financial statements and the daily pricing of publicly listed companies. It provides capital markets’ views which, with a bit of analytical imagination, can improve transparency and understanding particularly on absolute and relative value. Our analysis of the RISX index strongly confirm the relationship between long term relative performance and long term relative value, which should be of interest to those currently buying or selling Lloyd’s businesses.

For further information, including factsheet and methodology papers, see risxindex.com or contact us.